Override Taxes for a Specific Customer

Some customers—government agencies, non-profits, or specific contracted fleets—may be tax-exempt. MetaFleet lets you assign exemptions at the company level so technicians and admins never have to remember during billing.

Who this is for

Admins managing companies who require special tax handling.

What you’ll learn

• How to exempt a customer from all taxes

• How to exempt only certain taxes (labor only, parts only, etc.)

• How to verify exemptions on estimates and invoices

Before you start

• A Tax Group must be assigned to your Service Location

• Know which taxes the customer is exempt from

• Have Admin access to Companies

Quick Summary (TL;DR)

• Open Company

• Go to Taxes

• Add New Tax Exemption

• Select the Tax Group or specific taxes

• Save

Step-by-Step

-

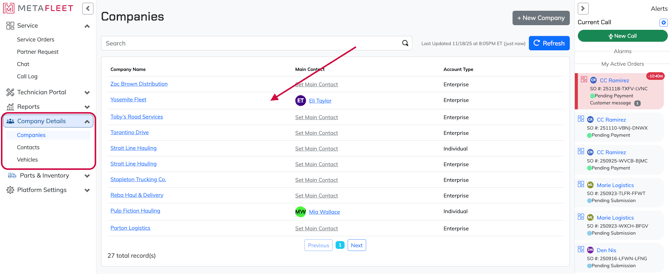

Navigate to Companiy Details → Companies.

-

Select the company you want to exempt.

-

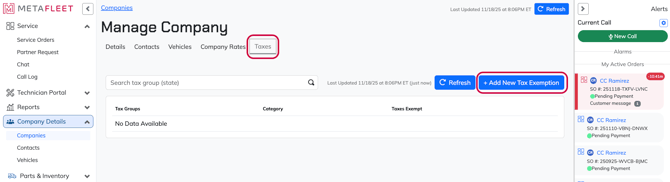

Open the Taxes tab.

-

Click Add New Tax Exemption.

-

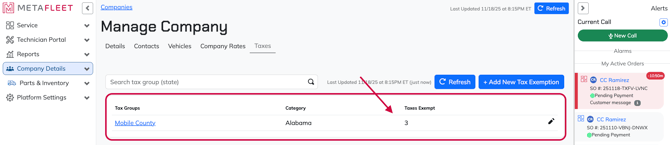

Choose from either:

• Entire Tax Group (exempts from all taxes in the group), or

• Specific taxes only (labor, parts, city, etc.)

-

Click Save. You'll now see how many exemptions from your selection apply to this customer.

Tip: If you need exemptions for only some taxes, create separate tax groups so you can control exemptions more precisely.

Troubleshooting

| Symptom | Cause | Fix | Prevent |

|---|---|---|---|

| Customer still being taxed | Wrong group selected | Edit exemption and choose correct taxes | Verify group before saving |

| Only some taxes removed | Exempted only from one category | Add additional exemptions | Create multiple groups if needed |

| Exemption not applying | Invoice created before exemption | Void and recreate invoice | Set exemption before billing |

FAQs

Can I exempt only labor or only parts?

Yes. Exempt by tax type or by group.

Does exemption affect past invoices?

No. It only applies to new billing.

Can I remove an exemption later?

Yes—edit or delete the exemption any time.