Assign Taxes to a Service Location

Taxes only calculate automatically when your Service Location has a Tax Group assigned. Without this, your shop may accidentally undercharge or miss required tax reporting.

Who this is for

Admins who manage shop settings and billing.

What you’ll learn

• How to attach a Tax Group to your Service Location

• How taxes flow into estimates and invoices

• How to change tax groups when the shop expands to new regions

Before you start

• Create Tax Categories

• Create your Tax Group

• Add all taxes into that group

Quick Summary (TL;DR)

• Open Service Location

• Edit

• Select Tax Group

• Save

Step-by-Step

-

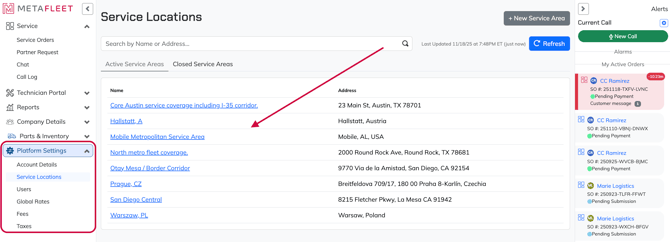

Go to Platform Settings → Service Locations.

-

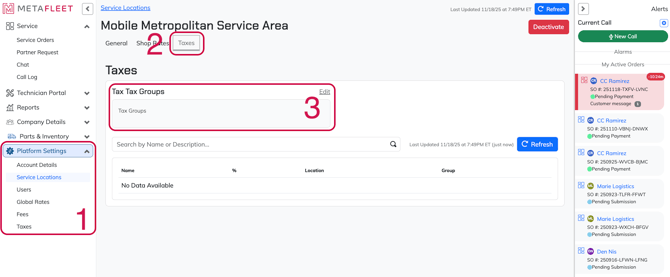

Choose the service location you want to add taxes to.

-

Click Edit.

-

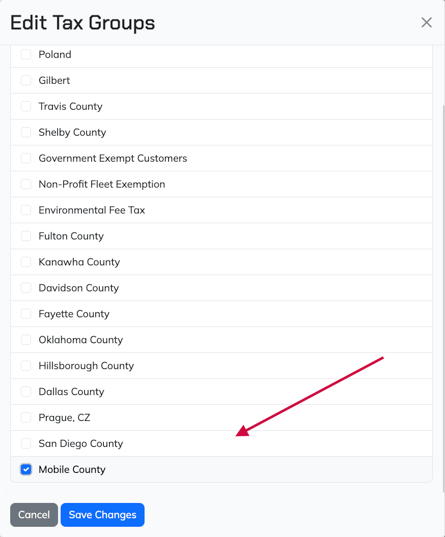

Find the Tax Group field and select the appropriate group.

-

Click Save Changes.

-

All new Estimates and Service Orders will now calculate taxes automatically.

Troubleshooting

| Symptom | Cause | Fix | Prevent |

|---|---|---|---|

| Tax not applying | No Tax Group selected | Edit location and assign group | Always assign group during onboarding |

| Wrong tax showing | Wrong group selected | Update group in location | Separate groups by city/county |

| Taxes triple-calculated | Duplicate taxes in group | Archive old taxes | Keep groups clean and organized |

FAQs

Can I change the tax group later?

Yes. New jobs use the new group automatically.

What if we expand into a new city?

Create a new Tax Category and Tax Group for that city.

Can I assign multiple groups to one location?

No—only one group can be active at a time.