Add Individual Taxes to a Tax Group

Your shop may need to track taxes separately for state, city, county, parts, or labor. Each of these must be entered as its own tax inside the Tax Group.

Who this is for

Admins setting up specific tax rates.

What you’ll learn

• How to add each tax

• How to choose what it applies to

• How to enable, disable, or archive taxes

Before you start

• Your Tax Group must already exist

• Have your tax rate from your local tax authority

• Know whether the tax applies to labor, parts, misc, or surcharges

Quick Summary (TL;DR)

• Open a Tax Group

• Click Add Tax

• Enter name, description, and rate

• Choose what it applies to

• Save and enable

Step-by-Step

-

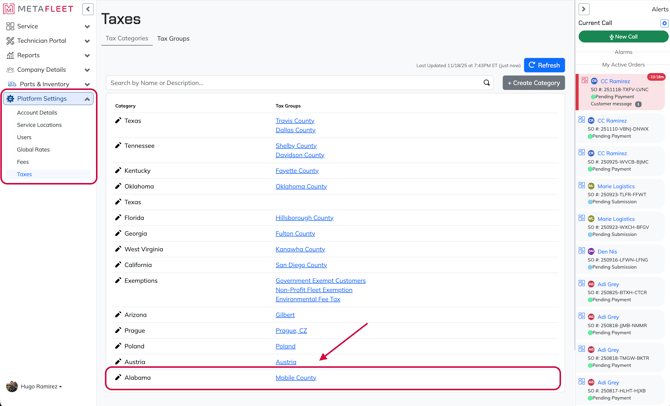

Open Platform Settings → Taxes → then select your Tax Group.

-

Click Create Tax.

-

Enter:

• Tax Name (ex: “State Sales Tax”, “City Sales Tax”, “County District Tax”)

• Description

• Rate — enter the correct percentage from your local tax authority

-

Choose the Tax Type:

• Labor

• Parts

• Miscellaneous

• Surcharge

-

Click Save.

-

Repeat for each tax required by your state/city/county.

Tip: If your reporting requires breaking out taxes separately, create separate tax entries instead of a single combined tax.

Troubleshooting

| Symptom | Cause | Fix | Prevent |

|---|---|---|---|

| Tax not applying | Wrong type selected | Edit tax → correct to labor/parts | Double-check tax type |

| Wrong total | Rate entered incorrectly | Update to correct percentage | Verify source |

| Tax appears twice | Old tax not archived | Archive unused taxes | Clean list regularly |

FAQs

Can I disable a tax instead of deleting it?

Yes. Disable or archive to avoid breaking past invoices.

Do I need separate taxes for labor and parts?

Only if your region taxes them differently.

Where do I enter combined tax rates?

You may enter a single combined tax if your region treats it as one.